Meteoroka – When it comes to protecting your belongings and ensuring your peace of mind, renters insurance is an essential investment. Many renters underestimate the value of their possessions and fail to realize the potential risks they face. Whether it’s a fire, theft, or natural disaster, having renters insurance can provide you with the financial protection you need.

According to the Insurance Information Institute, only 41% of renters in the United States have renters insurance. This means that a majority of renters are leaving themselves vulnerable to potential losses. Don’t be one of them. Take the necessary steps to safeguard your belongings and secure your future.

What Does Renters Insurance Cover?

Renters insurance typically provides coverage for three main areas:

- Personal Property: This includes coverage for your belongings, such as furniture, electronics, clothing, and appliances. In the event of theft, fire, or other covered perils, your insurance policy will help reimburse you for the cost of replacing or repairing your damaged or stolen items.

- Liability Protection: Renters insurance also offers liability protection, which covers you in case someone is injured while on your rented property. If a guest slips and falls or is bitten by your pet, for example, your insurance policy can help cover their medical expenses and any legal fees that may arise.

- Additional Living Expenses: In the event that your rented property becomes uninhabitable due to a covered loss, renters insurance can help cover the cost of temporary accommodations, such as hotel stays, meals, and other necessary expenses.

Factors Affecting the Cost of Renters Insurance

Several factors influence the cost of renters insurance. Understanding these factors can help you make an informed decision and find the best coverage at an affordable price:

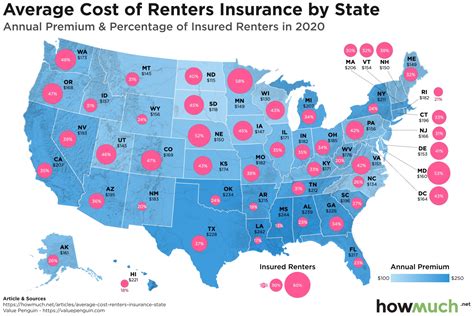

- Location: The location of your rented property plays a significant role in determining the cost of renters insurance. Areas prone to natural disasters or with higher crime rates may result in higher premiums.

- Amount of Coverage: The value of your personal property and the amount of coverage you choose will impact the cost of your insurance. It’s essential to accurately assess the value of your belongings to ensure you have adequate coverage.

- Deductible: The deductible is the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your premium but may require you to pay more in the event of a claim.

- Credit Score: In some states, insurance companies consider your credit score when determining your premium. Maintaining a good credit score can help you secure lower rates.

- Security Measures: Installing safety features such as smoke detectors, burglar alarms, and deadbolt locks can potentially lower your insurance premium.

How Much Does Renters Insurance Cost?

The cost of renters insurance varies depending on the factors mentioned above. On average, renters insurance can range from $15 to $30 per month. However, keep in mind that this is just an estimate, and your actual premium may be higher or lower based on your specific circumstances.

It’s important to shop around and compare quotes from different insurance providers to ensure you’re getting the best coverage at the most competitive price. Remember, the cheapest option may not always provide the level of coverage you need, so it’s crucial to strike a balance between affordability and adequate protection.

Ways to Save on Renters Insurance

While renters insurance is a valuable investment, there are ways to save on your premiums without compromising on coverage:

- Bundling: Consider bundling your renters insurance with other policies, such as auto insurance, from the same provider. Many insurance companies offer discounts for bundling multiple policies.

- Increasing Deductibles: Opting for a higher deductible can lower your monthly premium. However, make sure you can afford to pay the deductible in the event of a claim.

- Improving Security: Enhancing the security of your rented property by installing security systems, smoke detectors, and deadbolt locks can potentially qualify you for discounts.

- Good Credit Score: Maintaining a good credit score can help you secure lower insurance rates. Pay your bills on time and keep your credit utilization low to improve your credit score.

- Seeking Discounts: Inquire with insurance providers about any available discounts. Some companies offer discounts for non-smokers, seniors, or members of certain professional organizations.

Choosing the Right Renters Insurance Policy

When selecting a renters insurance policy, it’s essential to consider your specific needs and circumstances. Here are a few factors to keep in mind:

- Coverage Limits: Ensure that the policy you choose provides adequate coverage for your personal property. Take inventory of your belongings and estimate their value to determine the appropriate coverage limits.

- Additional Coverage: If you own high-value items such as jewelry, artwork, or electronics, consider adding additional coverage or a floater policy to protect these items.

- Policy Exclusions: Familiarize yourself with the policy exclusions to understand what is not covered. Some policies may exclude certain perils or have limitations on coverage for specific items.

- Claims Process: Research the insurance company’s reputation for handling claims efficiently and fairly. Read reviews and seek recommendations to ensure you choose a reliable provider.

- Customer Service: Consider the level of customer service provided by the insurance company. Prompt and helpful customer service can make a significant difference when filing a claim or seeking assistance.

Conclusion

Renters insurance is a crucial investment that provides financial protection and peace of mind. It covers your personal belongings, offers liability protection, and helps with additional living expenses in case of a covered loss. The cost of renters insurance depends on various factors such as location, coverage amount, deductible, credit score, and security measures.

While the average cost of renters insurance ranges from $15 to $30 per month, it’s important to shop around, compare quotes, and consider ways to save on premiums. Bundling policies, increasing deductibles, improving security, maintaining a good credit score, and seeking discounts are some strategies to lower your insurance costs.

When choosing a renters insurance policy, ensure that it provides adequate coverage for your personal property, consider additional coverage for high-value items, review policy exclusions, and research the insurance company’s claims process and customer service.